Introduction#

How did money become the basis of trade for such a long time? To have an answer for such question we must understand what money is and the different ways money has been used through the time.

Definition of Money#

Money is often defined it by the roles it plays:

It’s a store of value, meaning that money allows you to defer consumption until a later date.

It’s a unit of account, meaning that it allows you to assign a value to different goods without having to compare them. So instead of saying that a Rolex watch is worth six cows, you can just say it (or the cows) cost $10 000.

And it’s a medium of exchange, meaning it’s an easy and efficient way for different parties to trade goods and services with one another.

History of Money#

Even though we’re able to define what money is, when it comes to its origins, money has been mum about them. For such a central element of our lives, money’s ancient roots and the reasons for its invention are unclear, most of the available knowledge is based on conjectures and logical inferences.

Some economists assume that bartering of goods and services inspired money’s invention. On the other hand there are anthropologists and archaeologists contending that early states invented currency as a means of debt payment.

Several investigations suggest that money independently appeared for different reasons and assumed different tangible forms in many parts of the world, starting thousands of years ago and bartering had nothing to do with it but instead, money grew out of older systems of credit and debt. In small-scale societies, debts concern obligations to others while among hunter-gatherer and farming groups daughters given away in marriage create debts that are partially repaid with goods known as bridewealth where full repayment requires that the recipient of the first bride provide a bride in return. No cash needed.

Revisionists argue that a transition to a new form of money-friendly debt started at least 5,500 years ago in the agricultural states of Mesopotamia and Egypt. In Mesopotamia, the silver shekel — a lump of metal, not a coin — was a basic monetary measure. Rulers decreed that one shekel’s weight in silver was equivalent to a bushel of barley. Shekels of silver, gold and other metals were used in other ancient societies. Precise weights of shekels appear to have varied from one to the next one and therefore are difficult to pin down. Farmers were taxed to support royal lifestyles and public works, what the farmers and other commoners couldn’t pay in goods was recorded as debt in shekels. Merchants and tradespeople acquired goods from temple and palace officials on credit.

Coins stamped with images of animals or rulers, acting as denominations and guaranteeing the metal’s value, first appeared in the kingdom of Lydia around 2,600 years ago. Located in what is now Turkey, Lydia sat on the cusp between the Mediterranean and the Near East, and commerce with foreign travelers was common which was one of the major promoters for this coin mint to happen. To understand why, imagine doing a trade in the absence of money or in other words through barter. The chief problem with barter is the double coincidence of wants. Say you have a bunch of bananas and would like a pair of shoes, but it’s not enough to find someone who has some shoes or someone who wants some bananas. To make the trade, you need to find someone who has shoes they’re willing to trade and that wants bananas which is no easy task.

With a common currency, the task becomes easier: You just sell your bananas to someone in exchange for money, with which you then buy shoes from someone else. And if, as in Lydia, you have foreigners from whom you’d like to buy or to whom you’d like to sell, having a common medium of exchange is obviously valuable. That is, money is especially useful when dealing with people you don’t know and may never see again.

The Lydian system’s breakthrough was the standardized metal coin. Made of a gold-silver alloy called electrum, one coin was exactly like another—unlike, say, cattle. Also unlike cattle, the coins didn’t age or die or otherwise change over time. And they were much easier to carry around. Other kingdoms followed Lydia’s example, and coins became ubiquitous throughout the Mediterranean, with kingdoms stamping their insignia on the coins they minted. This had a dual effect: it facilitated the flow of trade, and it established the authority of the state.

The spread of money throughout the Mediterranean didn’t mean that it was universally used; soon after Lydia, cities and states in Greece, Persia, India and China began to strike their own coins, but even then most people were still subsistence farmers and existed largely outside the money economy. But as money became more common, it encouraged the spread of markets. Once a small part of the economy is taken over by markets and money, they tend to colonize the rest of the economy, gradually forcing out barter, feudalism, and other economic arrangements. This happens mostly because money makes market transactions so much easier and also because using money seems to redefine what people value, pushing them to view things in economic, rather than social, terms.

Governments were quick to embrace hard currency because it facilitated the collection of taxes and the building of military forces, coins funded armies and wars of conquest. In the process, coins became legal tender for all sorts of transactions. Marketplaces were a result of this system, not its cause, revisionists argue.

Once the Chinese had started making comparatively inexpensive paper from natural fibers, and discovered block-printing, paper currency came into use in the country. The first known use of paper currency in China is reported from the Tang dynasty and despite the fact that scarce information remains about this early system of paper currency there’s evidence that these were certificates issued by the Tang government to pay local merchants in distants parts of the empire. By using certificates, the government could avoid having to transport metal money far away. Each certificate had a certain amount of money stated on it and was redeemable for metal cash on demand in the Chinese capital. Most merchants never went through the trouble of going to the capital to get cash for their certificate, instead the certificates were used as money locally, since they were transfereable. The view of money as commodity began to shift only with the widespread adoption of paper currency.

Compared to traditional money made from precious metals, paper currency was easier to transport, and the use of paper currency also freed up metal that could be put to other use. In 1821, the Bank of England adopted the gold standard, promising to redeem its notes for gold upon request. As other countries followed suit, the gold standard became the general rule for developed economies. The discovery of major new gold fields over the course of the 19th century ensured that the money supply kept growing.

The gold standard, as it was intended to do, brought stability to prices and was enormously beneficial to property holders and lenders. However, it also brought deflation—that is, prices generally fell—because as countries, populations and economies grew, their governments had no easy way to increase the money supply short of mining more gold, and so money in effect became more scarce. Deflation was hard on farmers and borrowers, who longed for a little inflation to help them with their debts; when money gradually loses some of its value, so, too, do people’s debts.

What finally derailed the gold standard was World War I. Since governments needed more money for their militaries than they had in gold, and so they simply began printing it. And though many countries tried to return to the gold standard after the war, the Great Depression consequences made it end for good. Because of this currencies today are “fiat” currencies, meaning they’re backed by the authority of the issuing government, and nothing more.

In the United States, for example, that means the government accepts only dollars as payment for taxes and requires its creditors to accept dollars in payment for debts. But if people were to lose faith in the dollar and stop accepting it in everyday transactions, it would eventually become worthless. The reliance on fiat money, we’re told, gives too much power to the government, which can recklessly print as much money as it wants. Yet the truth is that this has always been possible. Even with the gold standard, governments revalued their currencies from time to time, in effect dictating a new price for gold, or they ignored the standard when it proved too limiting, as during the First World War. What’s more, the notion that gold is somehow more “real” than paper is, well, a mirage. Gold is valuable because we’ve collectively decided that it’s valuable and that we’ll accept goods and services in exchange for it. And that’s no different, ultimately, from our collective decision that colorful rectangles of paper are valuable and that we’ll accept goods and services in exchange for them.

Difference Between Money and Currency#

While most of the time, the terms “money” and “currency” are used interchangeably, there are some suggestions that these terms are not identical terms; these suggest that money is inherently an intangible concept, while currency is the physical or tangible manifestation of the intangible concept of money. By extension, according to this suggestions, money cannot be touched or smelled. Currency is the coin, note, or object that is presented as the physical form of money. The basic form of money is numbers; today some of the basic forms of currency are paper notes, coins, or plastic cards.

The powerful combination of computers and telecommunications, of smartphones and social media, of cryptography and virtual economies makes it seem like it’s a possibility to create a cashless society. What matters most about money is not what it is, but what it does. After all, people will use the currencies that lubricate commerce, allow people to exchange goods and services, and thus encourage people to work and create. Money, whether it’s represented by a metal coin, a shell or a piece of paper, doesn’t always have value. Its value depends on the importance that people place on it—as a store of value, a unit of account, and a medium of exchange. Money is valuable merely because everyone knows that it will be accepted as a form of payment. However, throughout history, both the usage and the form of money have evolved.

Definition of Cryptocurrencies#

Cryptocurrency is a digital or virtual form of currency; meaning it’s a representations of value, that uses cryptography to secure and verify transactions as well as to control the creation of new units.

Cryptocurrencies operate on systems that allow for secure online transactions to take place without the need for any central banks or intermediaries. Instead, transactions are recorded on a decentralized and distributed public ledger (DLT) called a blockchain, which is maintained by a network of computers around the world that record all transactions in a secure and transparent manner.

Definition of Blockchain Technology#

Blockchain technology is crucial to cryptocurrencies as it allows transactions to be processed and authenticated without any central authority. Instead of relying on a single, centralized authority to manage and store the data, blockchains rely on a network of computers to validate and record transactions, which makes them more secure and resistant to tampering or hacking. A blockchain offers a commonly agreed record of truth to multiple, mutually distrusting participants in an economic system since it keeps track of cryptocurrency transactions which are grouped into blocks. Each block is cryptographically linked to the previous one so as new blocks are added the older blocks become more difficult to modify. New blocks are replicated across all copies of the blockchain within the network, and any conflicts are resolved automatically using established rules.

A blockchain is spread across nodes usually in different locations. This is one of the key ideas about blockchain, and gives it its unique decentralized features. Because of this, anyone can submit information to be stored onto a blockchain and therefore it is important that there are processes in place that can ensure everyone agrees on what information to add and what to discard. Different networks use different methods but this procesess together are what’s called a consensus protocol and they are essentially the rules by which a network operates.

Definition of Consensus Protocol#

Consensus is a pervasive problem in many areas of human endeavor; consensus is the process of agreeing to one of several alternates proposed by a number of agents. Consensus can be defined as an agreement, protocols are rules which describe how an activity should be performed. Simply put, consensus protocols could be viewed as “agreement rules”.

A consensus protocol (also known as consensus mechanism or consensus algorithm) is used to achieve the necessary agreement on a single data value or a single state of the distributed ledger at any given time. It provides a method of review and confirmation of what data should be added to a blockchain’s record. Because blockchain networks typically don’t have a centralized authority dictating who is right or wrong, nodes on a blockchain all must agree on the state of the network, following the predefined rules, or protocol.

Current State of Blockchain Technology#

Bitcoin#

The Bitcoin blockchain was first introduced in 2008 through a white paper by its pseudonymous creator Satoshi Nakamoto as a peer-to-peer electronic cash system that allows users to send payments directly to each other using Bitcoin (BTC), the blockchain’s native currency, without the need for intermediaries such as financial institutions. The first Bitcoin transaction took place in January 2009, when Satoshi Nakamoto sent 10 Bitcoins to the first person who downloaded the software. The first commercial transaction using Bitcoin took place in 2010, when a programmer named Laszlo Hanyecz ordered two pizzas by paying 10,000 Bitcoins to an intermediary.

Bitcoin uses a proof of work (PoW) consensus protocol, in which miners compete to solve complex mathematical equations using their computing power. The first miner who succeeds in solving the cryptographic puzzle adds the latest block of transactions to the blockchain and receives rewards in the form of newly minted coins and transaction fees. This process is energy-intensive and was designed to be difficult on purpose to “prove” that participants have done the “work” and are eligible to add a new block to the blockchain.

The scripting language used in Bitcoin transactions is called Script. It is used almost exclusively to define how outputs can be spent and is responsible for enforcing the rules that govern Bitcoin transactions. In other words, Script determines who the BTC was sent to, how much was sent, and under what conditions it can be spent.

Ethereum#

Ethereum is a decentralized blockchain platform that revolutionized the way applications are built and executed. Founded in 2015 by co-founder Vitalik Buterin, who published its white paper in 2013, Ethereum offers a range of features that go beyond those of Bitcoin, including the possibility to create new cryptocurrencies and the ability to execute smart contracts, which are self-executing agreements encoded onto the blockchain, with the terms of the agreement between buyer and seller being directly written into lines of code without the need for intermediaries all while enforcing the negotiation or performance of the contract automatically. By enabling the execution of smart contracts, Ethereum opens up the possibility of creating decentralized applications (DApps), which operate transparently and independently without any central authority.

Like Bitcoin, Ethereum initially used a proof-of-work (PoW) consensus protocol, similar to Bitcoin, but it has undergone a major upgrade that moved it to a proof-of-stake (PoS) consensus protocol. Unlike Proof of Work (PoW) consensus models, where miners’ ability to validate block transactions is based on their hardware’s computing power, PoS models assign the task of validating new blocks based on the size of the node’s stake, with larger stakes having a higher likelihood of producing the next block. The PoS system aims to provide a more energy-efficient alternative to PoW while still maintaining the security of the blockchain. This upgrade on the concensus protocol aims to increase efficiency, security, and reduce environmental impact by eliminating the need for the intensive computational power that PoW requires.

The blockchain’s native currency is called Ether or ETH. Ether is used mainly for two purposes—it is traded as a digital currency on exchanges in the same fashion as other cryptocurrencies, and it is used on the Ethereum network to run applications. Therefore all decentralized applications built on Ethereum allow Ether and other crypto assets to be used in a plethora of different ways including as collateral for loans or be lent out to borrowers to earn interest. Collateral refers to assets pledged as security for repayment of a loan.

Ethereum offers multiple languages for programmers to develop smart contracts. The two most active and maintained languages are:

Solidity

Vyper

DecentralChain#

DecentralChain is a cutting-edge, secure and efficient blockchain ecosystem empowering smart contract creation, decentralized application (DApps) development and a thriving decentralized finance (DeFi) community. It utilizes a consensus protocol called Leased Proof of Stake (LPoS) which aims to improve upon traditional Proof of Stake (PoS) by allowing users to lease their stakes to other users, which increases the latter’s ability to produce new blocks. In return, the lender receives a percentage of the transaction fees earned by the validator. This leasing mechanism aims to address the possible centralization problem in traditional PoS models where a few large stakeholders control a significant portion of the network, and the decision-making power is concentrated in the hands of a small group of individuals or entities while at the same time allowing all users to earn rewards, extending the ability to participate in the network to not only minority stakeholders but also users who just want to lease their stakes to other users.

DecentralChain offers a unique approach to decentralized application development by avoiding high gas fees for all transactions. The blockchain’s native language, called Ride, is a non-Turing-complete language, which helps keep the system secure and predictable. Ride allows for the creation of smart contracts, which are self-executing agreements written in code that run without a central entity behind them. This provides a platform for decentralized applications (DApps), which are applications that work without a central authority. DecentralChain’s use of Ride and LPoS helps to ensure the stability and security of the network, making it an attractive option for decentralized application development.

DecentralChain Ecosystem#

The DecentralChain ecosystem enables secure communication and interoperability between different blockchain networks. The ecosystem uses protocols to facilitate the transfer of assets and information between blockchain networks, as well as incentivize sustainability by reducing carbon emissions per transaction and generating carbon credits. Additionally, the ecosystem encourages carbon sequestration, where the sequestered carbon is tokenized and can be traded on a blockchain platform. There is also a decentralized wallet and exchange built on the DecentralChain network that offers various benefits, such as fast execution rates, multi-chain capability, low fees, and interoperability.

Here are some of our most visited websites:

Wallet and Exchange#

Decentral.Exchange is an all-in-one platform that combines the features of a wallet, decentralized exchange, and cryptocurrency management tool into a single, seamless platform. Built on the DecentralChain blockchain, this platform offers numerous benefits to its users, including fast execution rates, multi-chain capability, low fees, and interoperability.

One of the most significant advantages of decentralized exchanges is that they are not controlled by any central authority, giving users complete control over their assets. Unlike centralized exchanges, there is no risk of funds being frozen or confiscated by a centralized entity. With Decentral.Exchange, users can also enjoy enhanced security, as their private keys are stored locally on their device, reducing the risk of cybercrime. Decentralized exchanges also provide access to a wider range of assets, thanks to the absence of restrictions on the number of tokens that can be traded. Decentral.Exchange takes this further with its multi-chain capability, allowing users to trade tokens across different blockchains seamlessly. Decentral.Exchange’s interoperability enables users to trade tokens across various chains and different decentralized exchanges, making it possible to access a broader range of assets effortlessly.

One of the key selling points of Decentral.Exchange is its low fees, which sets it apart from traditional centralized exchanges that often charge exorbitant fees. The absence of intermediaries means that users can keep more of their profits, making trading more accessible to everyone. In the DecentralChain ecosystem, having a native decentralized exchange is essential, as it facilitates easy buying and selling of DecentralChain tokens within the ecosystem. Additionally, project participants can create their tokens and trade them on the exchange. Decentral.Exchange also enables users to send and receive coins without the need for a centralized intermediary.

Decentral.Exchange is at the forefront of the future of crypto trading, providing users with a wide range of benefits that centralized exchanges cannot match. With its native blockchain, DecentralChain, Decentral.Exchange is ideally positioned to revolutionize the crypto industry and redefine the way we trade cryptocurrencies.

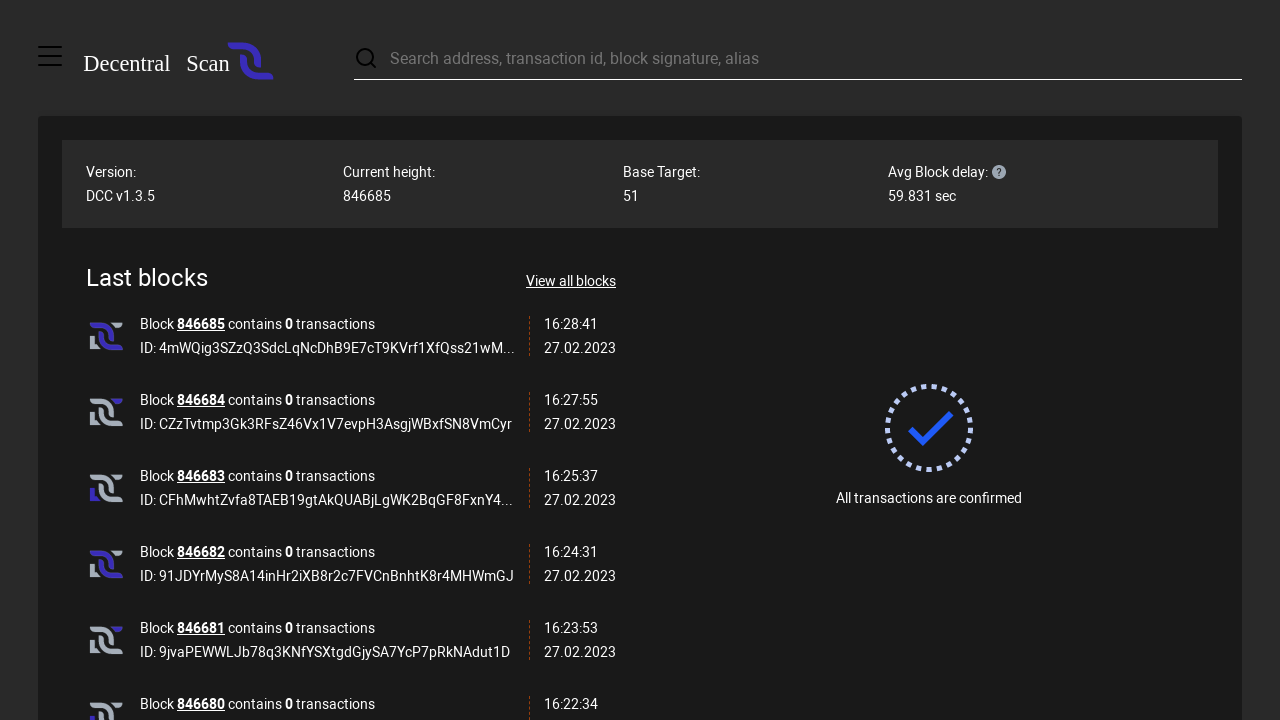

Blockchain Explorer#

DecentralScan.com is the official block explorer of the DecentralChain blockchain. It is a powerful tool that allows users to view, track, and analyze transactions on the DecentralChain blockchain. The block explorer provides a user-friendly interface that simplifies the navigation of the complex data stored on the blockchain.

One of the key benefits of DecentralScan.com is its ability to provide transparency to the DecentralChain ecosystem. It enables users to view all the transactions that have occurred on the blockchain in real-time, including the number of DecentralCoins (DCC) transferred, the addresses involved in the transaction, and the transaction timestamp. This makes it easy to track the movement of DCC and understand how the ecosystem is being used.

The block explorer is also valuable in its ability to provide detailed information about the nodes in the network. Users can view the current number of nodes, their geographical distribution, and information about each node, such as its uptime and the number of blocks it has mined. This information is essential for the DecentralChain ecosystem, as it allows users to view the distribution of the network and understand the ecosystem’s health.

In addition to tracking transactions and nodes, the block explorer also offers users a detailed view of the smart contract deployment on the blockchain. This is particularly useful for developers and businesses building on the DecentralChain blockchain, as it enables them to view and analyze deployed smart contracts, making it easier to identify bugs or potential vulnerabilities in the contract code.

Furthermore, the block explorer plays a vital role in ensuring the security of the DecentralChain ecosystem. By providing detailed information about transactions and nodes, it makes it easier for users to identify suspicious activity or potential security threats. The block explorer can also be used to track the movement of coins that have been stolen or lost, making it easier to recover them.

Inter-Chain Gateway Protocol#

The DecentralChain Inter-Chain Gateway is a blockchain mechanism designed to enable secure communication and interoperability between different blockchain networks. This is achieved by creating a decentralized network of nodes that utilize smart contract technology to validate and process transactions between different blockchains.

One major use case of the gateway is the ability to transfer assets between different blockchain networks. For example, if you hold Bitcoin but want to use it on another blockchain network, such as DecentralChain, the gateway can allow you to transfer your Bitcoin to the DecentralChain network, where it is converted into a form that is compatible with the DecentralChain blockchain.

In addition, the gateway facilitates the sharing of information between different blockchain networks. By creating a decentralized oracle network, smart contracts on different blockchain networks can access and utilize external data, enabling the creation of decentralized applications that use data from multiple sources and blockchain networks.

To ensure the network’s security, the gateway uses smart contract technology with predefined rules and conditions that are automatically executed when specific conditions are met. These conditions include input validation and access controls to ensure that only authorized parties can access and utilize the network’s information.

Proof of Incentivized Sustainability Protocol#

As society becomes increasingly aware of the impact of climate change, businesses and individuals are looking for ways to reduce their carbon footprint. In the realm of blockchain technology, the high energy consumption and resulting carbon emissions of Bitcoin transactions are particularly problematic. However, the DecentralChain blockchain presents a solution to this problem through the use of its proof of incentivized sustainability protocol.

The traditional Bitcoin blockchain consumes a significant amount of energy for each transaction, releasing large amounts of carbon emissions into the atmosphere. In contrast, the DecentralChain blockchain utilizes a proof of stake protocol which is more energy efficient, resulting in significantly lower carbon emissions per transaction.

The DecentralChain blockchain generates carbon credits through the proof of incentivized sustainability protocol. Every Bitcoin transaction on the DecentralChain blockchain creates new carbon credits, which can be sold or used to offset the carbon emissions of other activities. DecentralChain shares a percentage of these carbon credits as incentives to node owners who host their nodes on eco-friendly servers.

The equation to calculate the carbon emissions of the Bitcoin blockchain is:

Carbon Emissions = Electricity used (kWh) x Carbon Intensity (gCO2/kWh)

Using this equation, the carbon emissions of the Bitcoin blockchain can be compared to a proof of stake blockchain protocol like DecentralChain. The difference in carbon emissions between the two can then be used to generate carbon credits, creating a new market for businesses and individuals to offset their carbon emissions and invest in a sustainable future.

According to a study by the World Bank, carbon credits can yield a return of up to 7.2 percent annually over a 15-year period. This makes them an attractive investment for individuals and companies alike.

The DecentralChain blockchain not only provides a more sustainable alternative to traditional Bitcoin transactions but also creates new opportunities for businesses and individuals to invest in a sustainable future. By incentivizing sustainable practices through the proof of incentivized sustainability protocol and the hosting of nodes on eco-friendly servers, DecentralChain is paving the way for a greener, more sustainable future.

Carbon Sequestration#

Carbon sequestration, the process of capturing and storing carbon dioxide (CO2) to reduce its concentration in the atmosphere, is a critical strategy in mitigating the effects of climate change. Through the use of blockchain technology, carbon sequestration can be further incentivized, creating a new market for carbon credits.

One of the ways to achieve carbon sequestration is by buying property in Costa Rica and tokenizing the sequestered carbon in the form of a digital token that can be traded on a blockchain platform. The Costa Rican government’s initiative of National Forest Financing Fund (FONAFIFO) provides a financial incentive for private landowners to reforest and conserve their land, while also allowing them to receive payments for the carbon sequestered on their property in the form of carbon credits. By tokenizing these carbon credits on a blockchain platform, the carbon sequestration process can be further incentivized, creating a new market for carbon credits and a carbon credit-backed crypto-asset.

The tokenization of carbon credits on a blockchain platform not only increases transparency and traceability in the carbon market, but it also provides a new way for people to invest in the conservation of natural areas while obtaining the economic benefit of the carbon credits. This creates a win-win situation, in which the carbon sequestration is incentivized, and the conservation of natural areas is supported.

The tokenization of carbon credits on a blockchain platform creates a new market for carbon credits and enables the creation of a carbon credit-backed crypto-asset. This approach can increase transparency and traceability in the carbon market, making it easier to track and verify the carbon credits being traded. Moreover, it provides a new way for people to invest in the conservation of natural areas, while also obtaining the economic benefit of the carbon credits. The Costa Rican government’s initiative of National Forest Financing Fund (FONAFIFO) has set the base for this process, and with more involvement of the private sector, decentralized finance, and blockchain technology, this approach can be a step towards a sustainable future where everyone can participate in the conservation and mitigation of climate change.

Native Swap#

DecentralChain is an innovative blockchain platform that offers a wide range of features to its users, one of which is the upcoming DecentralChain native swap. A swap is a way for users to exchange one cryptocurrency for another, without the need for a centralized intermediary. In this essay, we will delve into how the DecentralChain native swap is expected to work, and explain how users will be able to use it to swap their DecentralCoin for other cryptocurrencies.

A swap is essentially a smart contract that facilitates the exchange of one cryptocurrency for another. When a user initiates a swap, their cryptocurrency is locked into the smart contract, and they receive the equivalent amount of the other cryptocurrency in return. The smart contract then releases the locked up cryptocurrency to the other user. This process happens on-chain, meaning that the swap is settled on the blockchain, and the transaction is recorded on the blockchain’s ledger.

The DecentralChain native swap is expected to be powered by an Automated Market Maker (AMM) algorithm. This algorithm will calculate the price of the coin based on the token supply and the liquidity in the swap. The price will be calculated using the constant product formula.

A swap platform can be thought of as a liquidity pool where users can deposit their tokens, and then use those tokens to swap for other tokens on the platform. As more users deposit tokens into the pool, the pool’s liquidity increases, making it more attractive for users to swap their tokens on the platform.

The DecentralChain native swap is expected to offer users a secure, efficient, and decentralized way to swap their cryptocurrencies. By eliminating the need for centralized intermediaries, users will be able to exchange their cryptocurrencies without relying on third parties, which can be slow, expensive, and risky. With the upcoming launch of the DecentralChain native swap, users will be able to experience the future of crypto swapping firsthand.

CR Coin#

CR Coin is a social currency proposed for Costa Rica, designed to provide a secure, efficient and environmentally-friendly medium of exchange for its citizens. The currency is built on the DecentralChain blockchain, a specialized platform for social currencies that ensures maximum security and scalability. It also incorporates carbon negative technology, which aims to minimize the environmental impact of blockchain-based transactions.

By introducing CR Coin, Costa Rica’s economy can enjoy the advantages of blockchain technology, such as transparency, low transaction costs, and secure transactions. Currently, cash, bank transfers and online payment systems are the most commonly used methods for payments in Costa Rica, but these traditional forms of money and payment systems have limitations and vulnerabilities, including fraud and high costs.

The launch of CR Coin is planned to involve a comprehensive marketing strategy, the establishment of a network of merchants and exchanges that accept CR Coin, and measures to ensure the security, stability and reliability of the currency. It is hoped that the introduction of CR Coin will not only provide a new medium of exchange for citizens but also create new opportunities for businesses, entrepreneurs and investors. CR Coin aims to revolutionize the way payments are made in Costa Rica, promoting sustainable development and environmental conservation with the potential to contribute to the country’s goal of becoming a carbon-neutral economy that could have significant benefits for Costa Rica and its citizens.

Moreover, the education and awareness initiatives and partnerships with schools and non-profit organizations planned by CR Coin will help raise awareness about the importance of preserving the environment and promoting sustainable practices. By combining technology, community engagement and education, CR Coin aims to be a driving force for sustainable development and environmental conservation in Costa Rica.